Financial planning for divorce and life after divorce

If you find yourself going through a relationship breakdown, coping with the emotional aspects is just one step in a long journey. Many legal and financial issues need to be addressed. If you have children, parenting plans will have to be worked out. Financial support for you, your children or your spouse must also be considered, and the property division needs to be settled.

If you find yourself going through a relationship breakdown, coping with the emotional aspects is just one step in a long journey. Many legal and financial issues need to be addressed. If you have children, parenting plans will have to be worked out. Financial support for you, your children or your spouse must also be considered, and the property division needs to be settled.

Before agreeing and signing your separation agreement, there are many steps to ensure you have protected your legal rights and made good financial decisions. The Fairway Method™ is designed to provide that each person becomes an empowered, well-informed decision-maker. One of the main areas of contention in divorce is around money. One party may be more vulnerable than the other, but regardless or who may have the upper hand financially, the outcome must be fair. In addition to being based on the Provincial Property Division Laws, it must make financial sense. Often, your decision around who gets what will also be dependent on support, so when making financial division assets, you must look at the big picture and consider lifestyle, careers, parenting, etc. Our divorce financial resolution experts work with you until we get an outcome to set you up for positive new beginnings.

At Fairway Divorce Solutions, we have worked with thousands of couples and individuals to help them reach a separation agreement. Often the best outcomes, especially when finances are complex, include the input of a Financial Planner. Financial Planning is a highly regulated industry and you can only call yourself a Financial Planner if you have the proper designations and are accredited by the associations.Our Fairway team works alongside your advisor to ensure that that outcome of division and support decisions are in line with your long term financial plan and that your goals can be achieved post-divorce.

Managing your finances can be challenging. However, it is often the decisions you make or don't make during transitional periods in your life that will impact your overall financial picture most.

Where do I start? Here are a few things to set you up for positive negotiations and future financial well-being:

Make a list of your assets and liabilities.

The first step is to organize your financial affairs to determine your assets and liabilities. Knowing your financial position lets you gain insight into your net worth to begin negotiations. Once you start working with Fairway, we provide you will all the documents needed for gathering your information so no need to worry.

Some of the information you should gather includes:

- Birth and marriage certificates

- Will and power of attorney documents

- Marriage contracts/domestic agreements

- Title deeds to your home and any other property you own

- Ownership records for your motor vehicles

- Investment account statements

- Tax returns and notices of assessments for you and your partner for the past three years

- Registered Retirement Savings Plans (RRSPs)

- Registered Retirement Income Funds (RRIFs)

- Locked-In Retirement Accounts (IRAs)

- All insurance policies (such as home, auto and life)

- Stock option plan statements

- Shareholder/partnership agreements

- Company pension statements

- DPP information statements

- Current bank account statements

- Current credit card statements

- Most recent mortgage statements

- Promissory notes or evidence of family loans

- Current statements of all other outstanding loans

- Corporate financial statements, if applicable

During divorce negotiations, you will need to know what sources of income you will receive to support yourself and any dependents. Sources of income can include employment income, interim spousal and child support, income from your investments, and income from retirement vehicles like your RRSP and RRIF.

Establish your personal credit, if you have not already done so

If you have never had a credit card in your name, consider applying for one. You may want to do this even before deciding whether or not to separate. Once you have established your credit, consider when to close all joint credit card accounts.

It would help if you also contemplated getting a line of credit in case you temporarily need cash while your financial affairs are being settled. The interest charges associated with a line of credit are generally much lower than credit cards. In addition, you should notify all other known creditors (such as your mortgage representative or bank loan officer) of your change in marital status. But before you talk to the bankers, ask your Fairway mediator on timing. You do not want to spook anyone about financial instability. Also, you should ensure your spouse cannot further bind you to new debt.

Open your own back account

If you do not have a sole bank account, you should open one. Once you have your bank account, consider closing any joint accounts shared with your partner. If any joint accounts need to remain open, ask that both signatures be required before any transactions are made. It would help if you also thought about revoking any bank powers of attorney you gave in favour of your partner. This has nothing to do with trust. You will need to prove your credit for any kind of future borrowing, including credit card applications.

Some couples leave one joint bank account to deal with household items or children, and that is fine as long as you both have signing authority and the account cannot be borrowed against (i.e. line of credit).

Notify your financial advisors of your status (timing is essential for banks)

If you hold any investment accounts in joint names with your spouse, notify your financial advisors of your status. You may want to rescind any trading authorization granted to your spouse. The timing of the ending of your marriage with regards to talking to your bank about your mortgage should be discussed with your Fairway mediator before you approach them, as you do not want to disrupt what does not need to be disrupted.

Getting advice from your financial planner and tax accountant

Some situations are more complicated than others, such as blended families, business owners, pension income from several sources and those having more than one ex-spouse or common-law partner. Even when a person's situation seems straightforward, there may be some tax-related twists and turns.

Some situations are more complicated than others, such as blended families, business owners, pension income from several sources and those having more than one ex-spouse or common-law partner. Even when a person's situation seems straightforward, there may be some tax-related twists and turns.

Here are some questions to ask to decide whether or not it is worthwhile to get the next level of professional assistance over and above your Mediator. A "yes" answer to these questions suggests that more help may be a good idea.

- Is there a significant amount of money involved?

- Will the answer to a tax question have a long-term effect?

- Is the uncertainty over the tax issue causing conflict between the divorcing spouse or common-law partners?

- Would the answer to the tax question(s) justify the cost of finding it out?

Tax issues can be daunting. Sometimes, understanding how to apply may take a lot of work and while it may be beyond your expertise, your Fairway Resolution Expert will facilitate all the conversations and ensure that you do not make decisions without full knowledge and understanding.

The average cost of a separation/divorce in Canada is now over $51,000

Client testimonials

Success comes in many forms. For us, it is hearing back from our clients and reading how we have changed their lives for the better. These stories are the reason we do what we do.

I would strongly recommend using this company. Sarah was very professional and friendly. Made a tough time manageable and doable. Also very economically reasonable.

- Fairway Client, November 2019

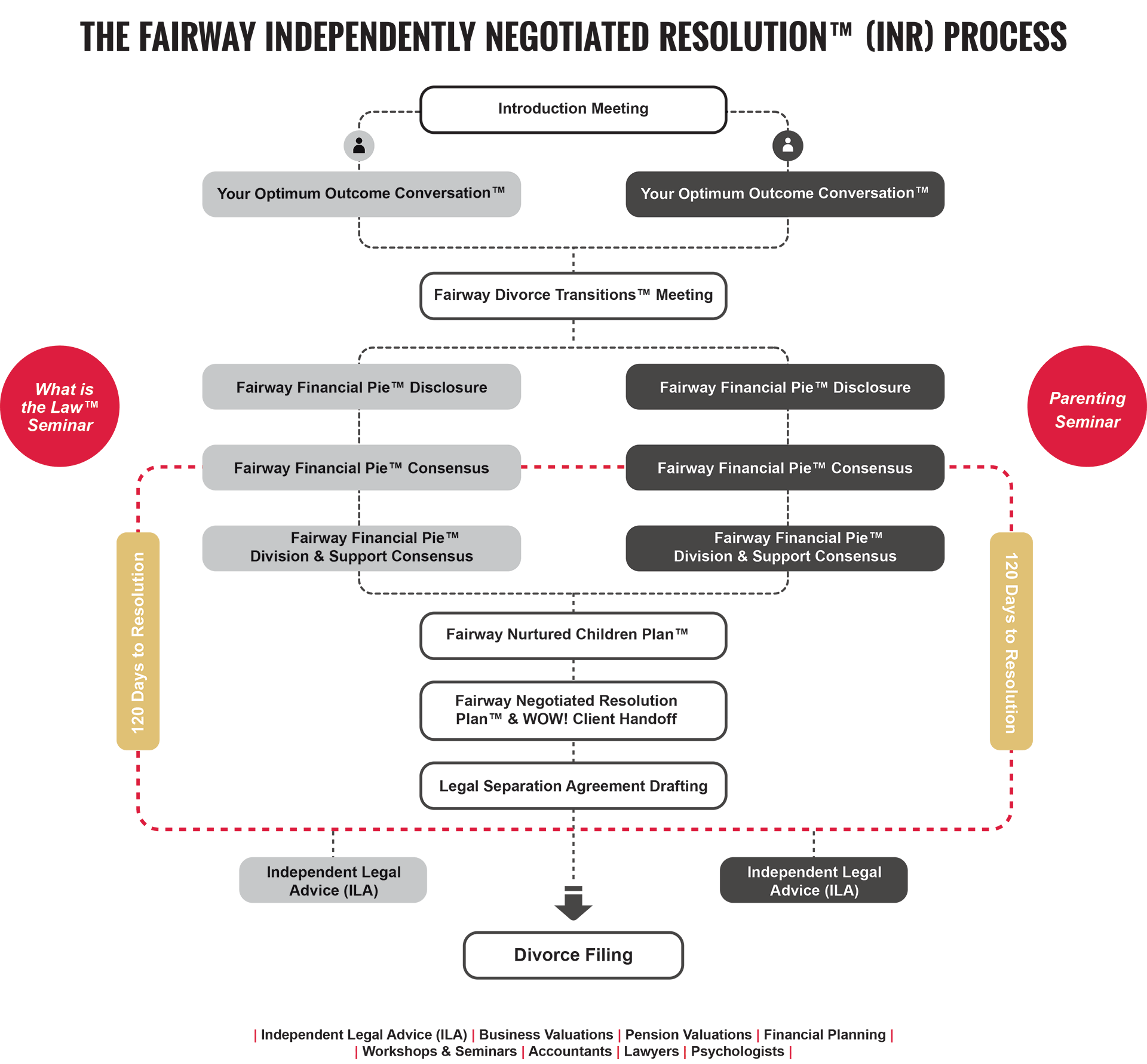

The Unique Fairway Method

Divorce is difficult. We make is easier from start to finish. The Clear Road to a New Life®

Fairway Divorce Solutions meets your needs

Locations

Helping Canadians with divorce mediation since 2006, with more than 25 Divorce Resolution Mediators in more than 12 locations.

Frequently asked questions

No, the step-by-step Fairway Process, we call Independently Negotiated Resolution™ (INR) was designed to work with each spouse separately to ensure that emotions, amicable or not, do not interfere with sound decision making. We take you and your spouse through a process that allows you to make decisions independently while bringing you both to a fair resolution around the division of assets and parenting. Thousands of couples have achieved resolution, for both amicable and highly conflicted situations.

Fairway Divorce Solutions charges a structured fee plan based on the complexity of your financial situation, parenting issues, and conflict. We offer a free introductory consultation so our resolution experts/ mediators can assess your situation and discuss the most appropriate fee structure. We are committed to reducing your cost and time so that you can move on with your life. Matrimonial lawyers charge by the hour and make more money by taking more time and creating more conflict.

Fairway Divorce Solutions has an in-house legal team that drafts your separation agreement and, in certain provinces, can file for divorce. Also, our matrimonial lawyers educate divorcing couples during the What is the Law™ Seminar. You are also encouraged to get independent legal advice from lawyers.

We designed The Fairway Process to work with both parties to bring resolution on all issues, including parenting, division of assets, spousal and child support. If one party refuses to use our alternative dispute resolution methodology, we can still help in other ways depending on your circumstances. Contact us to learn how we can help you avoid the damaging pitfalls of the traditional divorce legal system.

It is seldom too late. Fairway Divorce Solutions has helped couples frustrated with the cost, time and emotional strain of using lawyers. The Fairway team encourages divorcing couples to research and understand divorce options and choose a process designed to meet the needs of both parties and the children. The court process can often be paused to allow parties to explore and use Alternative Dispute Resolutions (ADR) methods.

Fairway Divorce Solutions aims to complete the process within 120 days from when you provide complete financial disclosure.

No, you do not need a lawyer to get divorced. However, it is highly recommended that a lawyer review your separation agreement before you sign it when children and assets are involved. Once you have a separation agreement, you do not need to use your lawyer to file for divorce. We offer divorce filing services in applicable provinces to make your life easier and keep costs down.

A divorce is a method of terminating a marriage between two individuals; your divorce will give each of you the legal right to marry someone else.